Futures Calendar Spread – In my previous article, I highlighted the buy or sell spread trades, which could be described as intra-market or calendar spreads, as they involve buying a futures contract in one month while . The Calendar spread definition can be understood in terms of the simultaneous purchase and sale of two futures contracts on the same underlying for different maturity contracts. For example .

Futures Calendar Spread

Source : www.investopedia.com

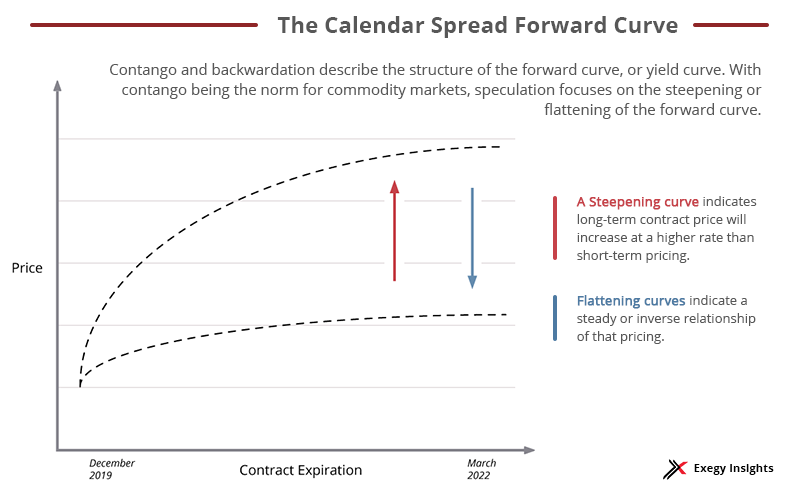

Getting Started with Calendar Spreads in Futures Exegy

Source : www.exegy.com

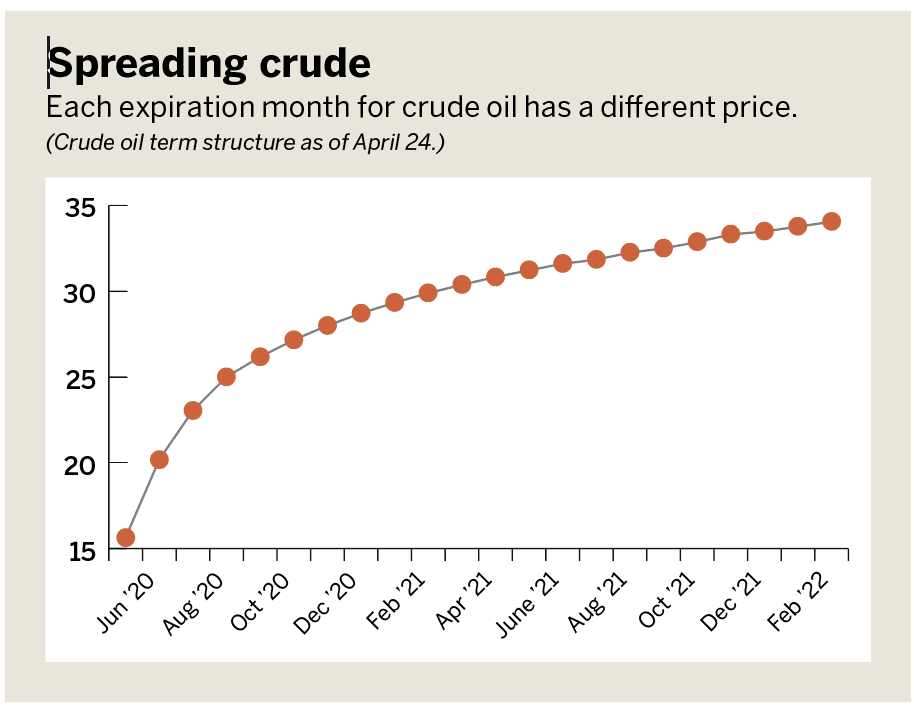

Leg Up on Futures Calendar Spreading luckbox magazine

Source : luckboxmagazine.com

Calendar Spread Definition: Day Trading Terminology Warrior Trading

Source : www.warriortrading.com

Calendar Spread Trading | Eris Futures

Source : www.erisfutures.com

What is a calendar spread in futures trading? Quora

Source : www.quora.com

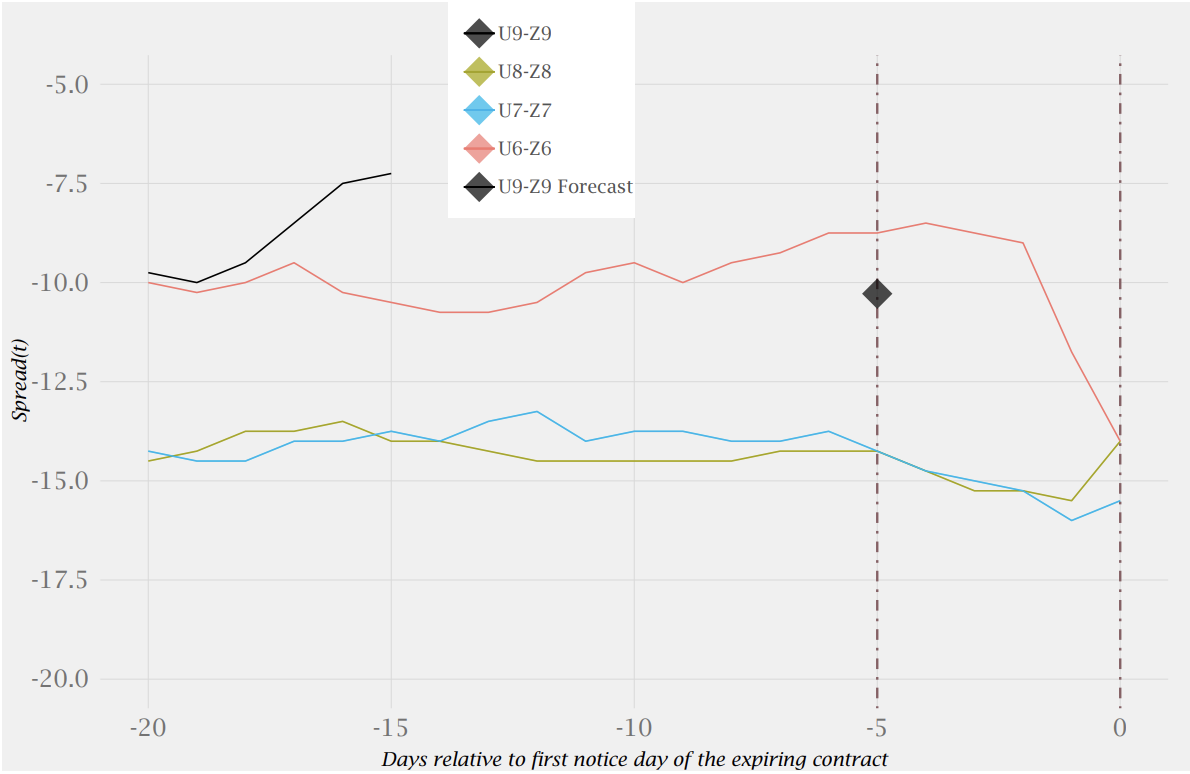

Descriptive Study of U.S Treasury Futures’ Calendar Spread Around

Source : quantitativebrokers.com

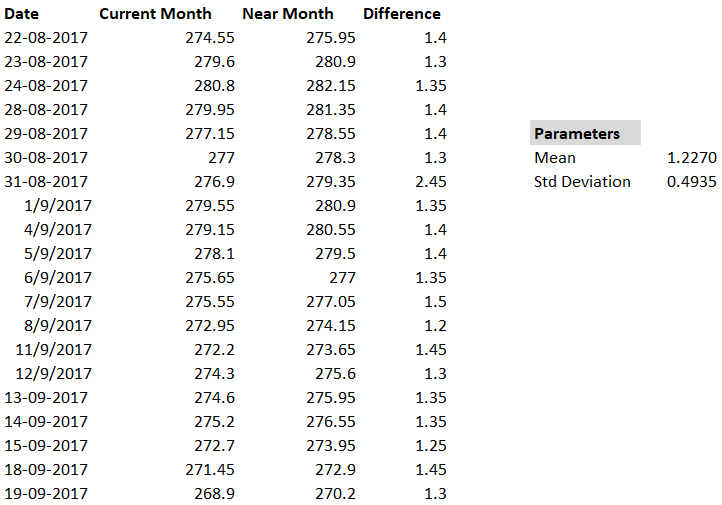

Calendar Spreads – Varsity by Zerodha

Source : zerodha.com

CME Wheat Futures’ Calendar Spread During The Roll Periods

Source : quantitativebrokers.com

TrendSpider Now Supports CME Group Futures Spread Contracts

Source : trendspider.com

Futures Calendar Spread Calendar Spreads in Futures and Options Trading Explained: Risico Openbaarmaking: Handelen in financiële instrumenten en/of cryptovaluta gaat gepaard met een hoog risico, zoals de kans dat u het volledige of een deel van het geïnvesteerde bedrag verliest. . Calendar spread indicate what is the gap in prices of two different expiry contracts of a particular commodity. This shows whether that commodity is moving in contango or backwardati .

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)